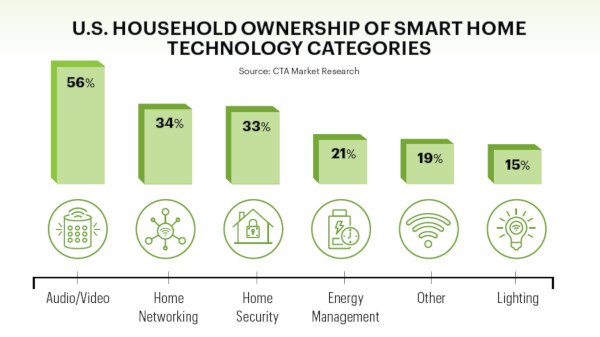

Audio and video devices maintain the greatest prevalence among U.S. households with 56% of respondents indicating ownership of one of these products. Home networking and home security are the second and third most owned products, respectively.

Among the products included in the survey, smart entertainment devices are the most commonly owned smart audio/video device in U.S. households. In fact, 45% of U.S. consumers own a smart entertainment device which include internet-connected streaming devices like the Apple TV or Roku, home gaming consoles, and DVD/Blu-ray players.

Beyond smart entertainment devices, 25% of U.S. households own smart speakers with a voice assistant. Altogether, audio/video products enjoy low costs and ubiquity, which address the top purchase motivator: convenience.

While home security products presently rank third in prevalence among U.S. households, survey respondents identifed this category as their top choice in terms of 12-month purchase intent. In particular, one-third of U.S. consumers plan to buy smart home security technology in the next 12 months.

Rising interest in home security products may be the result of this category’s ability to address more than just convenience, but to also generate a sense of tranquility for owners. After convenience at 67%, 58% of survey respondents listed peace of mind created by smart home technology as their second most common purchase motivator.

Video doorbells, internet-connected cameras and smart smoke/carbon monoxide detectors appeared as the top home security products for purchase intent. CTA estimates a 16% increase in shipment revenues for smart doorbells from 2019 to 2020, which will coincide with a projected 13% decrease in their wholesale price in the same period.

This reduction in wholesale price will aid video doorbells in overcoming one of the two most common barriers to purchase for smart home technology as indicated by respondents: cost. Both cost and finding time to focus on specific smart home technology were named as the two major challenges to purchase in survey responses. To mitigate these barriers, manufacturers must help consumers understand the value smart home technology can bring to their daily lives.

i3, the flagship magazine from the Consumer Technology Association (CTA)®, focuses on innovation in technology, policy and business as well as the entrepreneurs, industry leaders and startups that grow the consumer technology industry. Subscriptions to i3 are available free to qualified participants in the consumer electronics industry.