Research into consumer behavior has born concept stores like the Modern Retail Collective, which is actually a shopping test lab created by McKinsey and Company. Housed inside the Mall of America, the store features interactive mobile hotspots providing single-tap access to product details as well as the creation of virtual baskets. Smart mirrors and fit predictor software allow virtual trials of products outside of the fitting room. Faster future payment options include mobile and cryptocurrency capability.

Another quickly growing retail experience is the b8ta stores, designed for discovering, trying and buying innovative products. Consumers get to experience new innovations in a hands-on fashion that they wouldn’t normally have. Manufacturers and makers of products garner insights about how consumers interact with the products. Since its inception in 2015, b8ta has launched over 1,000 products and is now partnering with TRU, the new ToysRus brand to overhaul the toy store experience.

Both Modern Collective and b8ta are part of a growing number of retail as a service (RaaS) providers that mirror the software industry. Companies can now purchase solutions to speed store development. RaaS solutions bring technology to smaller providers to power online marketplaces, build out IT teams and manage inventory in addition to creating physical shops inside larger stores to test new products and services.

While many retail workers fret about jobs that will ultimately be replaced, robot optimists believe we’ve reached a detente where each contributes what they do best. Robots are being used in retail settings not to replace humans, but to augment, giving humans more time to offer personal interaction and services. Robots have been spotted doing everything from taking orders at restaurants to acting as baristas and bakers. For now, it’s a novelty experience for customers, provides important customer feedback and also offers back-of-the-store efficiencies and even delivery.

At select HSBC banks, Pepper the robot, greets customers gathering preliminary information for the bankers, short-circuiting the tedium of the process. Pepper offers tutorials and instructions on the latest banking technologies, products and services. And of course, the #PoseWithPepper feature puts some fun into banking.

At Walmart it’s become commonplace to see Bossa Nova’s robots checking for out of stock items, cleaning floors (think industrial-sized Roombas) and handling product unloading, scanning and sorting items from trucks. Stop and Shop introduced Marty, a robot with a built-in vision system to report (but not clean) spills, debris and other potential hazards to store employees.

Robot short-distance delivery is also being put to the test. On university campuses, robots like Starship and Kiwi’s DoorDash are delivering late-night pizzas or last-minute school supplies. In the hospitality, service robots like Sheraton Hotel’s Wayfinder guides you through the premises or delivers food and luggage to your room. Alibaba’s FlyZoo hotel in China features facial recognition doors, robot butlers and a bar that serves drinks made by a robotic arm. And a close cousin to robots are completely unattended shopping areas, being brought to life through companies like Standard Cognition and Iris Novus.

Data is at the heart of understanding the consumer. AI and machine learning study vast amounts of input, both human and sensor-generated to provide solutions to many problems that plague retailers. Why did my customer bail on their e-commerce purchase? How can I size this dress to fit more people realistically? How many jars of capers do I need in my store in Chicago vs. Denver?

AI employed by Walgreens helps the store reach out to customers in areas most likely to need flu shots. When combined with augmented reality (AR) and virtual reality (VR) presentation of virtual spaces to “what if ” with products, AI is busy at work collecting data from those consumer experiences.

PerfectCorp’s YouCam uses AI on the back end of its AR based makeup try-on experience to understand user preferences in makeup according to hundreds of different factors like skin tone, face shape and beauty preferences. Nobal’s interactive iMirror ties a store’s dressing room with inventory and point-of-sale (POS); the dressing room becomes your store. Spatial&, the newest portfolio company from Walmart’s Store N°8, and DreamWorks Animation presents virtual reality activations to immerse shopper’s in the merchandize. Using datasets, Northface customers are guided through finding and buying the perfect jacket using IBM’s Watson.

One of the biggest challenges faced by brands today is making customer connections at the precise moment they need your product. Brands, always looking for better ways to be discovered and connect with buyers, are turning away from keyboard search and increasingly experimenting with voice and visual search.

Still in its nascent phase, voice search platforms like Alexa, Google Home and Siri account for a negligible percent of retail purchases, but according to a study from OC&C Strategy Consultants, is predicted to hit $40 billion by 2022. An optimistic ComScore study suggests that 50% of all search will be conducted by voice by 2020, and 31% of retail marketers perceive voice search or smart hubs (i.e., Amazon Echo, Google Home) as a trend or challenge to watch closely. Two new consortiums of technology companies promise to alleviate confusion for developers when creating tools across the brand-owned platforms as Voice use progresses.

Equally nascent, visual search at retail is capturing interest as shoppers snap photos or choose images to kickstart their shopping process. A new breed of platforms lets consumers use their smartphone’s camera to snap pictures, while image recognition software delivers search results in the form of similar items. Computer vision identifies the images and creates matches to shoppable items. Retailers are busily uploading product catalogs as images, digitizing them through proprietary technology or third-party providers such as Slyce Interactive to drive sales, particularly with digitally native younger shoppers who are more likely to transact on mobile.

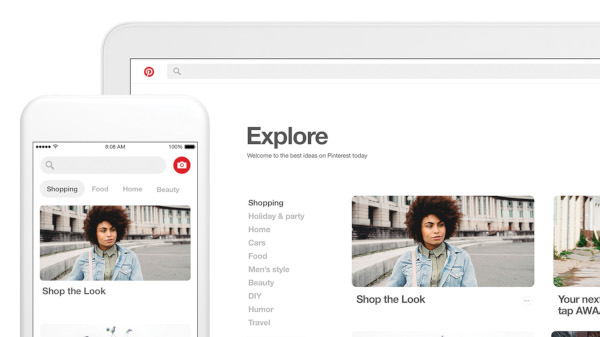

Google is a dominant player in visual search with Google Images responsible for 21% of image search, according to Sparktoro research. Amazon is quickly becoming a big competitor when it comes to Search as more consumers start looking for products there than a traditional search engine. And visual search can give the advantage to image-heavy social media platforms like Instagram and Pinterest. Pinterest’s Lens function more accurately identifies items from a Pinned image and makes those pins shoppable.

It’s only a matter of time before purchasing what you see becomes commonplace.

Tools for measuring shopper engagement are also getting more granular. Tracking eye-movement, facial reactions and bodily responses like GSR give researchers a look at customer engagement, retention and reaction to a wide variety of questions. Eye tracking can be done in the real world by asking consumers to wear special glasses while they shop or in lab settings where consumers use VR headsets to simulate real-world shopping. Facial expressions like frowning or arched eyebrows can signify a shopper’s displeasure or surprise. As eye tracking gear becomes more miniaturized, you’ll see the technology become more convenient and pervasive.

Location-based analytics have evolved from geo-fencing to more refined spatial identification inside stores pairing sensors and shelf tags with mobile devices. As consumers increasingly download apps and join retailers’ loyalty programs, they have opted into programs that shift tracking from anonymous to identified. That’s why merchants such as Target and Nordstrom have transitioned credit card-based loyalty programs to the more structured closed-loop Target Circle and Nordy Club programs accessible to a larger population. Retail is changing to provide consumers with a more customized experience wherever they shop.

i3, the flagship magazine from the Consumer Technology Association (CTA)®, focuses on innovation in technology, policy and business as well as the entrepreneurs, industry leaders and startups that grow the consumer technology industry. Subscriptions to i3 are available free to qualified participants in the consumer electronics industry.