60% Percentage of households that plan to purchase smart home products in the coming year

U.S. households own nearly 500 million smart home devices, and interest in devices such as smart speakers, doorbells, cameras, light bulbs, robots and appliances continues to grow. CTA’s Exploring the Smart Home 2022 report found that 60% of households plan to purchase smart home products in the year ahead. With so many devices available from different manufacturers, the industry continues to tackle interoperability challenges head on.

The Connectivity Standards Alliance developed the Matter standard, in part to make smart home products and devices from different manufacturers play well together.

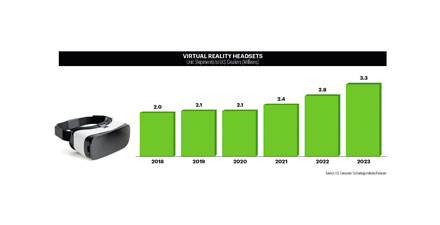

Gaming, one of the largest entertainment outlets in the U.S., accounted for more than $51 billion in software and subscription sales last year. Virtual reality (VR) will be particularly in-demand this year as major manufacturers unveil their latest headsets and raise the bar on immersive entertainment. CTA expects 3.3 million VR headsets to ship this year. PC gaming also stands to gain momentum this year, with plans to announce new graphics cards and processors during CES. As PC component prices shrink back down from their pandemic highs, more gamers will see opportunities to upgrade their rigs and enjoy better performance while playing the latest titles. (See this issue’s feature, “Gaming Levels Up,” to learn more about gaming’s future.)

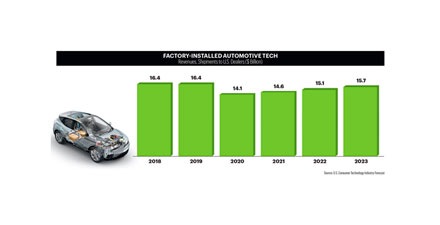

Factory-installed vehicle tech has endured a bumpier ride over the past three years, but car manufacturers continue to push the boundaries on automation and electrification. The vehicle tech segment should enjoy a smoother ride in 2023 as supply chain bottlenecks clear, and could generate more than $15 billion in revenue this year. The industry looks to improve battery tech, voice and gesture controls, vehicle-to-everything (V2X) infrastructure and heads-up displays.

More Trends to Watch

Among broader tech trends, the metaverse offers some of the more scintillating opportunities. Manufacturers of AR and VR gear look to improve headwear comfort and portability as well as graphics quality. New 3D audio and haptics devices will enhance the sound and feeling of immersive environments. On the software side, developers building virtual worlds continue learning how to tell more captivating stories in the space. Meanwhile, blockchain — in the form of non-fungible tokens (NFTs) — will determine the provenance and ownership of digital goods and creations in the metaverse, laying the groundwork for digital economies.

Companies will find new ways to tap the cloud to add value to their products. Services now take up a major part of device makers’ business plans, as consumers warm to the idea of on-demand lifestyles, paying for content and services monthly or as needed. CTA estimates that spending on software and services such as subscription audio and video streaming and gaming will exceed $130 billion in 2023.

Lastly, artificial intelligence (AI) continues to excite, but not without controversy. Consumers have already adopted voice recognition technology widely in the form of digital assistants, and they see interesting applications such as OpenAI’s DALL-E, which generates novel imagery with plain language prompts. Businesses also use AI to churn through massive amounts of data, while car manufacturers fine-tune computer vision algorithms that will propel self-driving vehicles. While the possibilities of AI seem limitless, industry will need to negotiate with regulatory bodies to ensure AI application fairness and transparency.