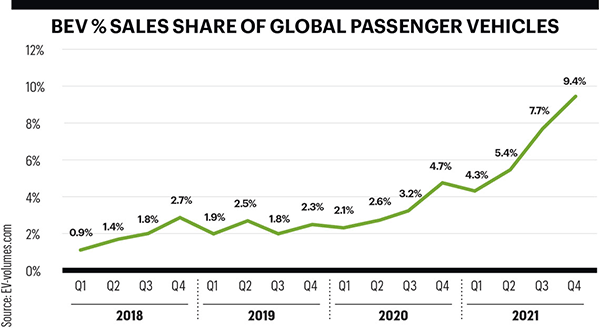

Q1: 0.9%

Q2: 1.4%

Q3: 1.8%

Q4: 2.7%

Q1: 1.9%

Q2: 2.5%

Q3: 1.8%

Q4: 2.3%

Q1: 2.1%

Q2: 2.6%

Q3: 3.2%

Q4: 4.7%

Q1: 4.3%

Q2: 5.4%

Q3: 7.7%

Q4: 9.4%

Perfect Tsunami

At the start of the pandemic in 2020, auto makers cut semiconductor orders in line with lean thinking. Chip makers allocated product capacity to other industries.

Semiconductors are used in thousands of modern products. Some have high value, and some can cost less than $1. Many of the 1400 semi conductors in cars are cheap, and low margin for semiconductor companies.

The pandemic drove an increase in PC, laptop and consumer electronic sales because of remote working. These products contain high-value chips, so they get production priority.

Two companies control 70% of the market: TSMC (Taiwan, 53%) and Samsung (South Korea, 17%). The next three firms bring that to 90%. New fabrication (fab) plants cost billions of dollars and take years to bring online.

Huawei and other Chinese companies began stockpiling semiconductors once the U.S. banned them from using U.S. designed chips. This reaction increased demand and cut supply. The unintended consequence has crippled U.S. car companies. And a factory fire in a semiconductor foundry in March 2021 further constrained chip supply.

Some analysts look at Tesla’s future product predictions with incredulity: 20 million cars a year by 2030.

But don’t bet against Tesla. It’s the auto firms that traditionally take six years to bring out a new model from research to concept, then design, engineering, manufacturing to launch — that may struggle.

They are being challenged to change not just their products, but their key processes: from gas to electric vehicles, from traditional manufacturing methods to robotics to keep up with Tesla (creating conflict with unions), from old suppliers to new ones (i.e., batteries). They’re being challenged to change everything at twice the speed.

Electrification of the $10 trillion a year transportation market is highly disruptive. I predict that at least two of the top 12 traditional car companies will cease to exist in the next five years. They will either go bankrupt, be bought or merge.

Jim Harris is the author of Blindsided. Follow him on Twitter @JimHarris or email him at jim@jimharris.com.

I3, the flagship magazine from the Consumer Technology Association (CTA)®, focuses on innovation in technology, policy and business as well as the entrepreneurs, industry leaders and startups that grow the consumer technology industry. Subscriptions to i3 are available free to qualified participants in the consumer electronics industry.