While live competition remains at the heart of eSports, organized matches of recognized players and teams fill only a fraction of game-related viewing time.

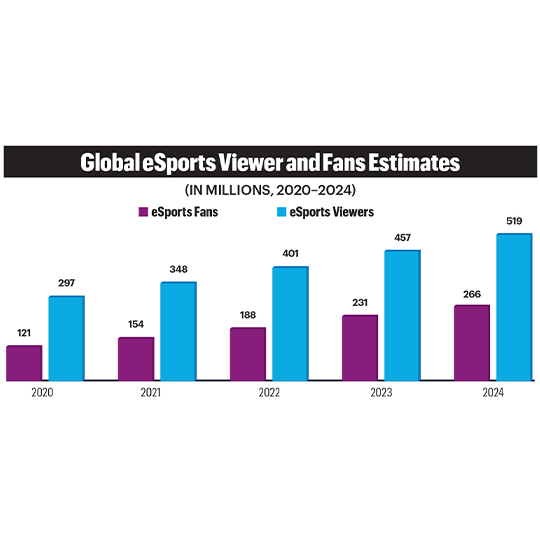

CTA’s white paper, produced in collaboration with Interpret (an international market research firm), acknowledges that the pandemic created a set-back for live events, which restricted in-person gaming tournaments and shifted much of the competition to online events. Nonetheless, “fundamentals of the industry remain strong and the eSports viewer base continues to grow,” CTA says. It cites Accenture’s analysis that the gaming industry gained half a billion players during the last three years, noting that growth will continue to come via mobile platforms plus demographic factors, especially participation from women and non-white gamers. The report acknowledges during the pandemic, “esports viewers, like many consumers, have been forced to cut back on entertainment expenses” but it foresees a recovery due to the strength of the underlying videogames sector.

“Teams that have fared well and increased their value this year, such as FaZe Clan and 100 Thieves, succeeded because they evolved into broader entertainment brands, not just eSports pros,” according to the report. It endorses “a focus on content creation in the gaming culture and fans’ affinity for team stars.” These factors generate stronger fan engagement and ultimately attract more sponsors.

The CTA analysis also foresees expansion in eSports. “While live competition remains at the heart of eSports, organized matches of recognized players and teams fill only a fraction of game-related viewing time,” CTA says. “Shoulder or scripted content allows teams and publishers to grow audiences between official events, promote their brands and create new opportunities for sponsorship.”

“The eSports industry is founded on collaboration with the tech industry,” explains Steven Hummel, manager of CTA Market Research. Citing “the massive growth” of eSports, Hummel envisions eSports’ role as a driver for diversity, inclusivity, and equal opportunities — what he calls “social good.”

Mike Lee, an eSports agent at United Talent Agency (UTA), says, “The definition of eSports has become very broad.” His agency team works on ways to showcase how players “can be a great fit with a brand.”

“Gaming is global, and social gaming platforms and audiences will only get larger as more people get access to interactive games and high-speed internet,” Lee predicts. “The game you play in the U.S. is the same game they play in China or Korea, but different regions gravitate towards different games. Mobile gaming is large in Asia and South America and console and PC gaming is popular in North America, Europe and eastern Asia.”

Lee believes that eSports audiences “will drive the future of the metaverse.”

“It’s an audience that has access to broadband internet, multiple smart devices, and is engaged and interacting with one another through platforms like Twitch, YouTube, Reddit and Twitter.”

Lee points out that viewership across Twitch and YouTube went up during the pandemic stay-at-home period, which increased the value of gamers. He says with traditional sports on hold, brands and agencies shifted some of their marketing dollars towards eSports. “Gaming and eSports became a great relief during the pandemic and will continue to do so,” Lee says.

As for the near future, Lee says to reach the next level of success eSports will need “the support of a major broadcaster or streaming platform.” Specifically, he envisions media groups will buy the distribution rights and leverage marketing dollars to drive the growth of competitive gaming.

Comparing it to NBC’s alliance with the Olympics and Turner Broadcasting’s relationship with the NBA, Lee says that “a gaming publisher like Riot or Activision needs to find the right partner who will grow the competitive scene together by marketing the players and matches.”

Lee explains “Live entertainers who drive engagement and fandom through casual game play can be great partners for big brands. Sharing these stories with advertisers and brands will help build the next Jordan brand or OVO.”

Lee says, “Like traditional sports, advertisers are realizing how important it is to partner with key personalities and work together to create campaigns and products that speak to the talent’s community such as Under Armor’s partnership with NickMercs, Oakley with Scump, and Sweetgreen with Valkyrae. We’re now seeing more talent-led campaigns, and brands wanting to consult with talent more than ever before.” (“NICKMERCS” is the playing name of Nicholas Kolcheff, a 31-year old competitive Twitch and YouTube streamer signed with FaZe Clan.

The most prominent trend is the gaming community’s effort to recruit more female players to eSports leagues or support more female game developers, the CTA study explains. “Gender parity initiatives not only are a showcase of social justice but also make business sense.”

For example, CTA’s report cites the percentage of female eSports participants as about 43% to 44% in China and India this year compared to 21% in the U.S. (lower than the 28% in 2020). In Australia, the female share of eSports players is 19% this year (versus 24% last year).

“The eSports and gaming industries are at the forefront of driving social justice causes, especially on the topics of gender and racial diversity and inclusiveness,” the report says, citing initiatives from game publishers, teams, technology companies and NGOs (non-governmental organization) “to advance social justice causes and bring impactful changes to our society.”

Cxmmunity, a nonprofit group working to increase diversity in the esports and video game industries, is hosting a 16-team NBA 2K tournament for historically black colleges and universities in partnership with Michael B. Jordan’s Invesco QQQ Legacy Classic. Separately, the Central Intercollegiate Athletic Association, the nation’s oldest historically black athletic conference, and the National Junior College Athletic Association Esports have partnered to develop collegiate eSports and gaming eSports at their member institutions. They aim to develop relationships and recruiting pipelines.

eSports are also attracting older participants. The Matagi Snipers is Japan’s first professional eSports team with all its members over 66 years old. The team was established as a way to show the health benefits of esports for older adults, as well as to impress the grandkids. Twenty-one people applied to join the team, but only eight made the cut, according to NHK.

CTA’s report cites mobile platforms as “an important area of expansion for core gaming IP thanks to titles like Fortnite, PUBG Mobile, Free Fire, and Call of Duty Mobile.”

“The growth potential for eSports on mobile is enormous, which is very hard for sponsors and investors to ignore,” the study explains. “The rise of mobile platforms like Skillz and games like Among Us has highlighted the importance of serving a ‘social’ or light gamer.”

CTA’s white paper is filled with data points showing the foundations of eSports usage, such as:

6.3 billion hours of eSports watched on Twitch in Q1 2021 compared to 3.1 billion a year earlier.

12.5 million unique channels of streaming content on Twitch: more than double the year-earlier level

Average concurrent viewership also doubled from the previous year. At the end of March 2021, Twitch saw its viewership more than double from a year earlier and has achieved a significant increase in market share in the U.S.

However, the industry faces a slew of technical, financial and operational challenges during this growth spurt. For example, an Intertrust report chronicled the security challenges arising in eSports, including content theft and hacking that disrupts business via piracy.

There will also be questions about how the star players are compensated. Top-earning eSports players are more influencers than elite athletes, as Forbes described recently. The elite are earning millions of dollars annually by leveraging their massive online followings into endorsements, fees and sponsorships.

Nonetheless, for eSports, the future is aggressively, “Game On."

I3, the flagship magazine from the Consumer Technology Association (CTA)®, focuses on innovation in technology, policy and business as well as the entrepreneurs, industry leaders and startups that grow the consumer technology industry. Subscriptions to i3 are available free to qualified participants in the consumer electronics industry.